FAQs

Frequently Asked Credit Repair | Educate Yourself.

What is a Credit Score?

A credit score is a number generated by a mathematical formula that is meant to predict credit worthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to get a loan. The lower your score is, the less likely you are to get a loan. If you have a low credit score and you do manage to get approved for credit then your interest rate will be much higher than someone who had a good credit score and borrowed money. Therefore, having a high credit score can save many thousands of dollars over the life of your mortgage, auto loan, or credit card.

What Factors Make Up My Credit Score?

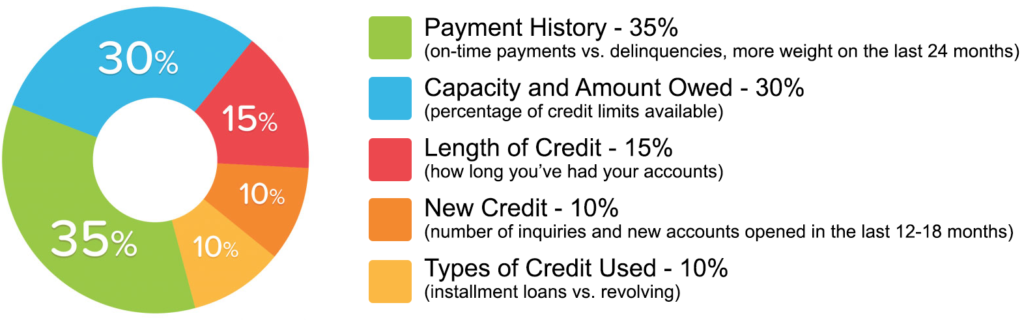

FICO® and VantageScore® use proprietary algorithms to produce your credit scores. While there are multiple FICO® score models for each of the 3 bureaus (28 among the three), both FICO® and VantageScore® base your scores on the data currently listed on your credit report on any given day. Fair Isaac Corp. (FICO®) was created in 1956 by William Fair and Earl Isaac. According to FICO®, the following 5 primary factors make up your credit score in all models.

Payment History

Since 35% of your score is reflective of your payment habits, it makes sense that on-time bill payment should be priority one in building and maintaining a high credit score.

Credit Usage

While most so-called “experts”, as well as each of the 3 major credit bureaus, recommend using no more than 30% of your total credit card limit to avoid lowering credit scores, using below 20% of the limit will produce significantly higher score results. Why this information is not published by the bureaus will be explained in another publishing called: The Credit Bureaus Number One Client. Your credit utilization percentage is responsible for about 30% of your score.

Historic Length/Age of Credit

As your credit items age, scores will increase. The length/age of your credit history accounts for about 15% of the score. Those new to credit (“Thin Files”) would normally need to wait it out to benefit from this aged record increase in scores, but there are ethical and legal ways to take advantage of this increase.

Credit Types/Mix

While account balances and payment history combined account for up to 65% of your total credit scores, the types of accounts you maintain are responsible for about 10% of credit scores. Credit scores are enhanced when there is a healthy mix of different credit types. These types might include a combination of revolving credit accounts (accounts with usage limits and varying balances and payments), and fixed payment installment loans (like an auto loan/lease). To learn more about adding these items, see our article titled: Why Is My Credit Score So Low?

New Credit and Inquiries

Applying for a car loan, credit card, furniture, or even adding cable service or a cellphone account will likely result in one or more hard inquiries. Hard inquiries typically lower your credit score by 0-15 points. The damage (if any) caused by inquiries will usually fade as each month passes. If you use a credit monitoring service to check your credit, no inquiry will show, nor will it impact your scores. Our readers can obtain a “No Inquiry” 7 Day Trial which includes all 3 Bureaus and FICO® Score 8 for $1 HERE. Credit applications and new accounts may affect your score as much as 10% whether or not the inquiry results in approval.

How To Legally Age Your Credit

Credit repair results are not the same for all persons. There is not a way to set a standard time or result outcome for any clients’ service outcome. Even if two people had the identical file, there is a likelihood that both would produce somewhat different results.

From historical data of many past clients, it is common to see the majority of the positive results by the end of month 3 or 4 when the account is properly addressed, but this is not always the outcome.

Why Is My Credit Score So Low?

The obvious most common offender of a credit score is poor credit history. Not all bad credit is the result of purposeful neglect. Read Below.

Poor Credit History

The obvious most common offender of a credit score is poor credit history. Not all bad credit is the result of purposeful neglect. In fact, many people do not even discover that their credit is below the national average score between 673 and 695 (depending on which scoring model is used) until they are put in the embarrassing position of finding out at the time of applying for goods or services. Oftentimes, it is only at these times a medical deductible, late payment, or even an unknown account is discovered.

This is why it is important to regularly check your credit monthly, or at least prior to application for anything that will result in an inquiry to your credit report. You can do this without causing any inquiry or damage to your scores using a credit monitoring service. Our readers can obtain a $1 “No Inquiry” 7 Day Trial which includes all 3 Bureaus and VantageScore® or FICO® 8 Score HERE.

Improper Mix of Credit Types

Many of our readers report that they pay all of their accounts in a timely manner, keep low balances on their accounts, and don’t allow their credit to be run unless absolutely necessary. They also report that while they follow these steps religiously, they cannot seem to get their credit scores to move upward. This is usually due to an insufficient balance of the proper mix of credit types. It is vital to have multiple credit types for a healthy credit score.

This mix would include both revolving and installment accounts

A revolving account (like a credit card) would have a borrowing limit and a variable monthly payment based on the current balance. An installment loan (like a car or personal loan) has a fixed monthly payment and closes once the balance has been completely paid in full. For revolving credit types, you can select from various cards for all levels of creditworthiness on our Build Credit Now page. For Installment credit for all levels of credit, and with no inquiry, you can select a Self Lender account. This reports to all 3 bureaus monthly while building a savings account for 12 months. If you are not sure of what your credit profile might be missing, you can have us complete a FREE evaluation and schedule a consultation to find out HERE.

Short History of Time Reported on The Bureaus

If you are new to credit, or you are rebuilding from a profile that has little or no credit items due to aging off items, you are likely missing out on what makes up about 15% of your total credit score. There is no time machine to change this, but you can actually age your credit profile.

Revolving Credit Card Balances Too High

While most so-called “experts”, as well as each of the 3 major credit bureaus, recommend using no more than 30% of your total credit card limit to avoid lowering credit scores, using below 20% of the limit will produce significantly higher score results. Why this information is not published by the bureaus will be explained in another publishing called: The Credit Bureaus Number One Client. Your credit utilization percentage is responsible for about 30% of your score.

Stale Credit Activity

Let’s say you have $0 balances on all accounts, the correct mix of credit types, and a long history of perfect repayment. While this may seem the proper use of your credit, it could result in a lower, or missing credit score. This can occur when there is no activity on any of your accounts for an extended period of time. At 3 to 6 months of no activity, credit scores can be lowered because the scoring system does not see what it considers “recent activity” in which to base a person’s current ability to repay. After 6 months of no activity, it is very possible that an inquiry of your credit would return with no score. This can be corrected by simply utilizing a very small amount of an open revolving account, and paying it off over a few months. It is a good idea to rotate the use of existing revolving accounts every few months to prevent the card issuer from reducing your credit limit, or possibly closing your account due to non-activity. A closed card will reduce the amount of available revolving credit, which in turn may lower your scores.

Too Many New Loans or Applications

Even if you apply for 5 credit cards on the same day and are approved, the result may be a lower credit score for a long period of time. It may appear to the scoring system that you are desperate for cash access via these cards, making your new available credit limits a liability rather than an asset. Multiple inquiries would not affect your score more than 1 inquiry for the same purpose in a two-week period or possibly longer, but a would-be lender may give a second thought to approving you for a needed loan because of the visual effect of multiple inquiries.

What will my credit score be after you fix my Credit?

Many will ask to forecast or predict the outcome of their service, or the credit score they might expect.

We never make predictions as to outcomes or scores because that would infer that I know the proprietary algorithm of “FICO”.

Don’t believe anyone who attempts to have you believe they can do so.

What we can give you is historical data reference from persons with similar files to your own, which you can find HERE

How long can negative credit info remain on my credit report?

- Delinquencies: (30- 180 days): A delinquency may remain on file for seven years; from the date of the initial missed payment.

- Collection Accounts: May remain seven years from the date of the initial missed payment that led to the collection (the original delinquency date). When a collection account is paid in full, it will be marked as a “paid collection” on the credit report.

- Charge-off Accounts: When a delinquent account is sent to a collections company. This will remain for seven years from the date of the initial missed payment that led to the charge-off (the original delinquency date), even if payments are later made on the charge-off account.

- Closed Accounts: Closed accounts are no longer available for further use and may or may not have a zero balance. Closed accounts with delinquencies remain for seven years from the date they are reported closed, whether closed by the creditor or by the consumer. However, the delinquency notation will be removed seven years after the delinquency occurred when pertaining to late payments. Positive closed accounts continue to be reported for ten years from the closing date.

- Lost Credit Card: If there are no delinquencies, credit cards reported as lost will continue to be listed for two years from the date the creditor is contacted. Delinquent payments that occurred before the card was lost are reported for seven years.

- Bankruptcy: Chapters 7, 11, and 12 will remain on one’s credit report for ten years from the filing date. A Chapter 13 bankruptcy is reported for seven years from the filing date. Accounts included in a bankruptcy will remain for seven years from the date reported as included in the bankruptcy

- Judgments: Remain seven years from the date filed.

- City, County, State, and Federal Tax Liens: Unpaid tax liens remain for fifteen years from the filing date. A paid tax lien will remain on one’s score for 10 years from the date of payment.

- Inquiries: Most inquiries listed on one’s credit report will remain for two years. All inquiries must remain for a minimum of one year from the date the inquiry was made. Some inquiries, such as employment or pre-approved offers of credit, will show only on a personal credit report pulled by you.

Information that cannot be in a credit report:

- Medical information (unless you provide consent)

- Notice of bankruptcy (Chapter 11) more than ten years old

- Debts (including delinquent child support payments) more than seven years old

- Age, marital status, or race (if requested from a current or prospective employer)

Why is my credit score different than the score on Credit Karma?

The “Free” credit scores that you see advertised on television and online are typically never those which are used in making retail or mortgage credit decisions.

In fact, they are usually not even actual credit scores used in lending decisions.

Even when purchased directly from the 3 bureaus, they will not normally supply you with the actual scores.

Will I build credit by using my debit card for purchases?

Not at all!

This is completely false. Debit cards are just like writing checks from your bank account.

They do not get reported to the credit reporting agencies unless you somehow overdraft them, and then only negative credit is reported.

Will closing credit cards help my credit score?

In most cases, No! Closing revolving lines of credit typically does the opposite. When you close revolving credit lines, you are reducing the available credit percentage from your profile.

Revolving credit pay history, average age of revolving credit, and utilization percentages are responsible for 30% or more of your credit scores.

If one Credit Reporting Agency deletes an item, will the other two also delete?

The Credit Reporting Agencies (Experian, Equifax, and TransUnion) are privately owned businesses which are not defendant on each other for the data which they store or delete. If one or two credit reporting agencies adds or deletes an item to their report, it does not mean that the third is required to do so.

A report of Fraud or Identity Theft is among the only times the Credit Bureaus are required to cooperate and notify the other.

How many different credit scores are there?

There are currently 28 versions of the FICO score.

There are 10 for Experian, and 9 each for Equifax and Transunion.

Each version uses all of the information contained on that bureau, but weighs the items differently depending on the purpose of the inquiry.

A mortgage FICO score will differ from an automobile FICO, and both will differ from a credit card or personal loan FICO.

Be aware that most online credit monitoring sites do not provide actual FICO scores, but simulations which are often far from accurate because of the many variables between purposes.

If I pay all of my collections and charged off accounts will I have perfect credit?

Sadly, paying off collections or charged off items may actually harm your credit scores.

I suggest speaking for free with one of our credit repair specialists who can explain some options, and when/if it is a good idea to pay one or more of these items.

Ultimately, negative items do not fall off because you paid them.

How do I know that my information is safe with you?

You are absolutely correct to be cautious of anyone you are sharing sensitive information with. We are registered and regulated by The Department of Justice, Office of The Attorney General.

You should also do extensive search on the internet via Google etc. for reviews and evaluations of any company you are considering in an effort to satisfy your concerns.

Rest assured, your information is secure with TS Consultations LLC..

I received an offer to settle an old credit collection for less than I owe. Should I accept?

There are many things to consider when receiving these offers.

Is the debt really yours?

Does the company have the right to collect this money?

How will it affect my credit report if I accept?

How do I know they will honor the agreement?

Please ask us before contacting these companies for a free analysis of the offer.